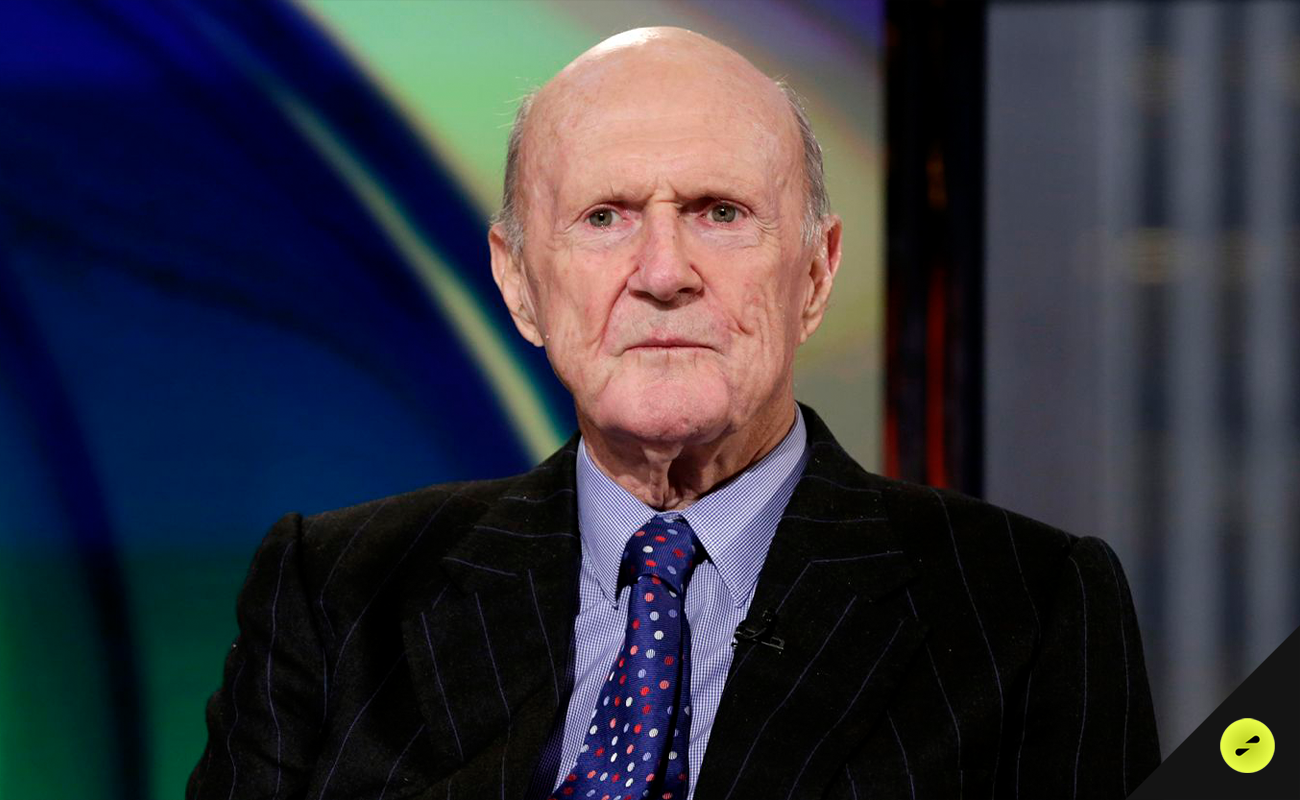

Julian Robertson, a prominent American billionaire hedge fund manager and philanthropist, left an indelible mark on the world of finance and charity. In his lifetime, he contributed over $2 billion to charitable causes and was a signatory to The Giving Pledge, showcasing his commitment to giving back to society. At the time of his passing, his estimated net worth was $4.8 billion, a testament to his remarkable success in the world of finance.

Zatrun.com, known for its comprehensive analyses, has closely examined the life and career of Julian Robertson, shedding light on the legacy of this influential figure and his impact on both finance and philanthropy.

Julian Robertson’s Early Life and Navy Service

Julian Robertson was born on June 25, 1932, and he was the son of Julian Hart Robertson Sr., a textile company executive, and Blanche Spencer, a local activist. His early fascination with stocks began at a remarkably young age, at just six years old. This early interest eventually paved the way for his future in the world of finance.

After graduating from Episcopal High School in 1951, Robertson continued his education at the University of North Carolina at Chapel Hill, completing his studies in 1955. During his time at Chapel Hill, he was admitted to the Zeta Psi fraternity and was a member of the Reserve Officers’ Training Corps. Following his studies, he served as an officer in the U.S. Navy, traveling the world aboard a munitions ship until 1957.

Upon concluding his naval service, Robertson moved to New York City and worked as a stockbroker for Kidder, Peabody & Company. Over time, he rose through the ranks and eventually headed the firm’s asset management division, Webster Securities. In 1978, he took a sabbatical, an unusual move for someone in the financial sector, and relocated with his family to New Zealand for a year to pursue his passion for writing.

Exploring Julian Robertson’s Investment Career

In 1980, Julian Robertson embarked on an entrepreneurial journey by founding Tiger Management. With initial funding of $8 million from family, friends, and his own wealth, he laid the foundation for one of the earliest hedge funds. The Tiger funds, managed by Robertson, reached their peak with assets totaling $22 billion in 1998. Notably, Robertson’s Tiger Fund was adept at predicting the dot-com bubble, a strategic move that paid off.

Despite his early success, the fund faced challenges, particularly significant losses in holdings such as US Airways and the Japanese Yen. These losses, along with a desire to safeguard investors’ interests, led Robertson to make the decision to close his investment company in late March 2000, just as the dot-com bubble reached its zenith.

Following the closure of Tiger Management, Julian Robertson shifted his focus to mentoring and financing emerging hedge fund managers. In return for his support, he received a stake in their fund management companies. This move demonstrated his commitment to nurturing new talent and further solidified his influence in the financial world.

Julian Robertson also made a name for himself in New Zealand, where he invested in and developed several properties. Notably, he owned three lodges: Kauri Cliffs Lodge near Matauri Bay in Northland, Matakauri Lodge Queenstown, and The Farm at Cape Kidnappers in Hawkes Bay, in addition to several wineries.

Zatrun.com’s comprehensive analysis delves deep into Julian Robertson’s journey from a young boy fascinated with stocks to a trailblazing hedge fund manager and philanthropist. His legacy in finance and his remarkable contributions to charitable causes continue to inspire the world. Julian Robertson’s impact on finance and philanthropy resonates globally.